The last Retiree News post below was on July 1, 2022. Since then, there have been requests for a restart of the website.

Earlier this year, Maj. Gen. Kenneth Hara, The Adjutant General, asked his Public Affairs Office (PAO) to restart the Retiree News website. Over the summer, the PAO staff transferred over 2,000 existing posts from the old site to the new one.

The Retiree News website, Version 2.0, had its first post on September 4, 2024. New posts will be published when they become available. There will be posts sharing more Hawaii National Guard (HING) history, upcoming events, recent promotions / retirements / awards, Veteran resources, news and more. Go to https://dod.hawaii.gov/retireenews/ to see the new website.

Like the original website, you can receive email notifications of new posts. Go to https://dod.hawaii.gov/retireenews/home/contact-info/ to register.

We want to express our appreciation to General Hara and the Public Affairs Office for restarting Retiree News.

The first post on the Retiree News website was on Tuesday, January 22, 2013. The post said,

Retiree News began as an electronic newsletter and has evolved to this blog. Definitely more to come…

There have been 10,500 posts over the last nine and a half years. Posts included promotion and retirement announcements, new benefits, old photographs, and the sharing of health information. Unfortunately, there were too many “Taps” posts announcing the passing of our friends, but we are all growing older.

There have been over 1,750,000 views. Numerically, the “Check Six” posts generated a lot of interest. The photographs of old friends and events hopefully brought memories of our past in the Guard.

Preserving our Guard history is important – no, critical, so future generations have a source where they can discover stories of Guard personalities and activities of our past. Hopefully there is a younger person out there who will continue the Retiree News tradition.

Before closing, I need to thank all those who submitted photographs and story ideas over the years. I would be remiss if I didn’t single out these retired Guardmembers who consistently submitted materials and information for posts, especially identifying people in photographs.

Billy Chang, John “JC” Chun, Clinton “Church” Churchill, Tai “Mynah” Hong, Dave Howard, Edmund “Fred” Hyun, Bob Inouye, Kyle Kamikawa, Gordon Lau, Blossom Logan, Randall Lum. Steve Lum, Yvette Miraflor, Ed Miyahira, Vern Nakasone, Stan “Ossum” Osserman, Edward Richardson, Donna Shimazu, the late Melvin “Humphrey” Souza, Wayne “Wildman” Wakeman, Erik Wong and Sam Wong.

Special thanks to the Public Affairs staff of the State Department of Defense and the 154th Wing for their support.

As I posted earlier, Retiree News started in 2013, the initial intent was a 2–3-year gig; it has lasted over nine years. Earlier, Retiree News was an e-newsletter from 2006-2012.

What does that mean for the future of Retiree News? I’m not sure. The website itself will remain up. But, as far as current posts go, this is it ….

Thank you – it has been a great run and a wonderful ride.

Me Ka Aloha Pumehana, Aloha Kākou

BREAK RIGHT

As the run of Retiree News ends, the story of William “Bill” Crawford, a Army retiree who worked as a janitor at the Air Force Academy, needs to be retold.

Colonel James E. Moschgat told Bill Crawford’s story in an article in the December 2001 issue of the Wharton Leadership Digest.

There was an earlier Retiree News post but we found additional information and believe it needs sharing.

William “Bill” Crawford certainly was an unimpressive figure, one you could easily overlook during a hectic day at the U.S. Air Force Academy. Mr. Crawford, as most of us referred to him back in the late 1970s, was our squadron janitor.

While we cadets busied ourselves preparing for academic exams, athletic events, Saturday morning parades and room inspections, or never-ending leadership classes, Bill quietly moved about the squadron mopping and buffing floors, emptying trash cans, cleaning toilets, or just tidying up the mess 100 college-age kids can leave in a dormitory. Sadly, and for many years, few of us gave him much notice, rendering little more than a passing nod or throwing a curt, “G’morning!” in his direction as we hurried off to our daily duties.

In January 1968, the capture of the U.S.S. Pueblo and the Tet Offensive caused President Lyndon Johnson to reverse his policy on using the reserve components in the Vietnam War.

The Air National Guard mobilized eight tactical fighter groups that were a part of the Department of Defense’s Selective Reserve Force (SRF), known in the Air Force as “Beef Broth” and later “Combat Beef,” and in late April, the initial four squadrons of Air Guard F-100C Super Sabres deployed to Vietnam.

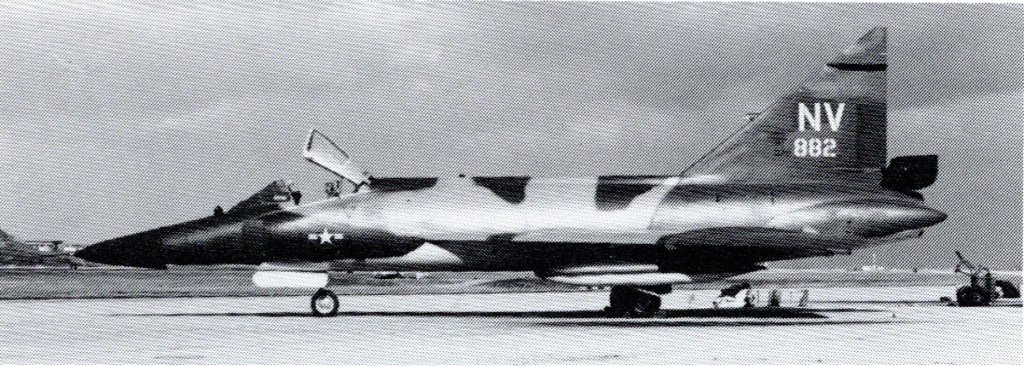

Operation Palace Alert was an Air National Guard program to augment Air Force air defense units in Southeast Asia and in Europe. Combat ready pilots from 20 Air National Guard units flying F-102A Delta Daggers were eligible to volunteer.

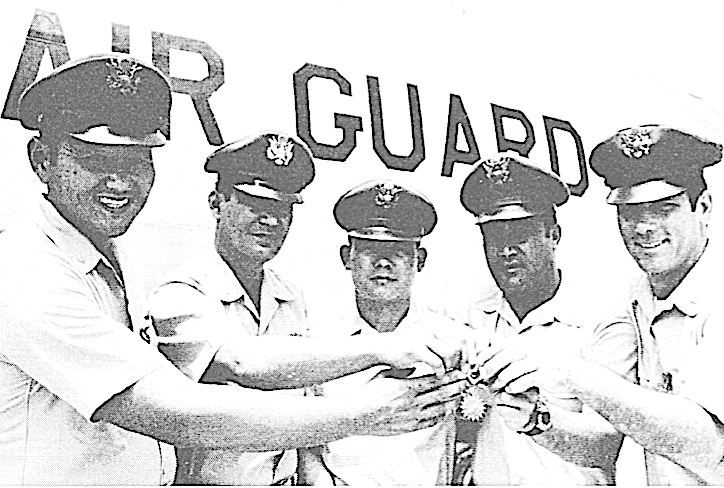

Then-Maj Harold Nagai, operations officer for the Hawaii Air National Guard played a primary role in putting the program togethers. Nagai, a qualified F-102 pilot in addition to his duties as an operations officer said, “We think it’s a good program and will give us (Air Guard pilots) the benefit of overseas flying experience.” Nagai was the first Deuce pilots from the 199th Fighter Squadron to volunteer for the program. Others to follow include Lawrence Cabrina, Rexford Hitchcock, Kurt Johnson, George Joy, Richie Kunichika, Marvin Little, Jon Parish, Gerald Sada, and Edward Richardson. These pilots were awarded Air Medals for their deployments.

Palace Alert got under way on July 1, 1968, with 17 pilots operating in Europe from bases in Germany and Holland, five in Okinawa, and ten in Clark AFB, Philippines. Those operating out of Clark deployed to other Southeast Asia bases including mission over Vietnam. These bases included Tan Son Nhut, Bien Hoa, and Da Nang in South Vietnam and also stood alert at Don Muang and Udorn in Thailand.

The Air Guardmembers were serving on short active duty tours ranging from 89-179 days. The initial program required the Air Guardmembers to maintain a commitment of 32 pilots on station over a two year period. Volumeters served the maximum six month tour which required 128 pilots to sustain the requirement. The program was later expanded to 100 pilots on station, which would require at least 400 volunteers during the two year period.

The 32 pilot program represented the equivalent of an additional active duty squadron. The program did not hinder the capability of the runway alert forces to perform their day to day mission of air defense.

The Hawai’i Air National Guard needs to establish a way to ensure proper recognition of individuals who have made significant contributions to our organization.

This program would be open to current and former member of the Hawai’i Air Guard, living or deceased. Eligibility would be based on distinguished professional achievement and

service in the Guard or the community. Civilian employees would be eligible.

Whatever the program is called – Hall of Honor, Hall of Fame, Flight Honor – it needs to be established soon. Memories of those who served in the 1940s, 50s and 60s are fading. Inductions could be limited to a few a year, but the initial years, more Guardmembers could be considered to “catch up.”

* * * * * * * * * * * * * *

For consideration: Norman Ault, Robert Choi, Denise Jelinski-Hall, Arthur Ishimoto, Kurt Johnson, Walter Judd, John Lee, Howard Okita, Stanley Osserman, Edward Richardson, Kenji Sumida

The Kūkā‘ilimoku is the official e-newsletter of the 154th Wing, Hawaii Air National Guard. The first issue came in September 1957 and continues as an e-newsletter today.

Today we feature the June 1965 Kūkā‘ilimoku issue. This issue includes the following stories:

* Employers Day at Summer Camp

* Promotions: Harold Mattos, Allen Mizumoto, Owen Muramatsu

* Officers off to UPT

The Hawai‘i State Department of Defense once held their Awards and Retirement luncheons twice a year. These luncheons recognized retiring Federal and state employees. Current employees who achieved 10, 20, 30 or more years of longevity received service awards. Luncheons were held at the Hale Koa Hotel.

This photograph shows Samuel Kekuna, Moises Felipe, Sandy Hoggan, Antone Gabriel, and Norman Kaleo and at the August 22, 2008 luncheon.

Sam was great aircraft mechanic. He was always smiling and had a story to tell. Unfortunately he passed away in 2017.

Moises was the boss at the Fabrication Shop for many years. After retiring, he volunteers at the Pearl Harbor Aviation Museum.

Sandy enlisted in the Hawaii Air National Guard and later was commissioned. She served as a navigator in the 203rd Air Refueling Squadron. She lost her long, courageous battle with cancer in 2015.

Gabe was a fixture on the flightline, serving for many years before his retirement. Another great mechanic.

Norm was a steadfast aircraft mechanic who served many years with the 154th Wing after his active Air Force service. He served in the Royal Guard during his years of service. Friends call him “Capt Buckaloose”.

Related Retiree News posts:

Check Six – 2009: Two Maintenance Group Members

In an earlier Retiree News post – Aviator Call Signs: The History & Naming Rituals – we linked an Department of Defense article about aviator call signs. The night before posting – for some reason – we started to list call signs of some members of the 199th Fighter Squadron.

The list generated a lot of email feedback. Emails provided additional names and call signs. Some emails came with associated memories. Other emails called us out to list the call signs with the names of the aircrew.

It took a while, but we now have the list to share. Please note, some aircrew had more that one call sign in their flying career. If you have corrections or additions, please email Retiree News.

The Kūkā‘ilimoku is the official e-newsletter of the 154th Wing, Hawaii Air National Guard. The first issue came in September 1957 and continues as an e-newsletter today.

Today we feature the June 1973 Kūkā‘ilimoku issue. This issue includes the following stories:

* Space “A” limitations for Guard and Reserve members lifted

* Promotions: including Monte Mitchell, Carl Simmons, Wesley Yasutake

* Ancillary Training

WASHINGTON — By creating an account on Login.gov, Veterans can now use the same login and password to access a growing list of federal government websites, including the Department of Veterans Affairs, Office of Personnel Management and Small Business Administration to deliver a secure and streamlined identity verification experience.

Currently, Veterans can login to VA.gov, My HealtheVet and VA’s flagship Health and Benefits mobile app using Login.gov.

Operated by the General Services Administration’s Technology Transformation Services, the availability of Login.gov at VA marks a major milestone in improving how Veterans access their benefits and services.

Implementing Login.gov fulfills a key objective of President Biden’s Executive Order on Transforming Federal Customer Experience and VA plays an integral role in innovative technologies driving simplified access to the world-class care and benefits Veterans have earned.

“Login.gov is a secure digital credential designed to streamline how users access government benefits and services,” said Chief Technology Officer Charles Worthington. “As part of the department’s digital transformation efforts focused on continuous improvement, we’re embracing the innovative technology designed by Login.gov to provide our Veterans a seamless sign-in experience to better serve, engage and enhance the customer experience.”

“This is an important example of using technology to deliver services that provide convenient access to benefits while supporting Veterans as they transition into civilian life,” said Director of General Services Administration’s Technology Transformation Services Dave Zvenyach. “It’s our mission at GSA to provide a secure and seamless digital experience for Veterans and those supporting them.”

The launch of Login.gov follows several other digital transformations including the relaunch of VA.gov, and the launch of VA’s flagship mobile application enabling Veterans to schedule and track health care appointments.

To learn more about the sign-in experience visit Login.gov.

Retirement ceremonies are an important part of a person’s military career. Many times retirees join currently serving members to honor the newest retiree.

William Petti‘s ceremony was June 25, 2010 at the 154th Wing’s dining facility. Among the attendees were (L-R) Calvin Yoshimoto, Gregory Ng, Allen Mizumoto, and Stanley “Ossum” Osserman.

Cal served many years in the maintenance complex, first in fighters and later became a member of the startup of the 203rd Air Refueling Squadron. His son, Curtis, remains a pilot with the 199th Fighter Squadron.

Greg retired from the Hawai’i Air National Guard in 2006 and his civilian position at the Pearl Harbor Naval Shipyard in 2008. He passed away on May 29, 2020.

Allen Mizumoto retired in 1993 after serving as the Commander, Hawaii Air National Guard. He continues to enjoy his retirement.

Ossum’s retirement ceremony was on July 13, 2014 at the new F-22 Raptor hanger. He worked for the State of Hawaii on the hydrogen power project and retired two years ago.

Blazon: On an Air Force golden yellow Hawaiian shield, oval and pointed at the extremities, and bordered black, a stylized Hawaiian idol black, eyes, nose, mouth and markings voided of the field, malo red, above four shock waves radiating from middle base point upward flanking the idol, two on either side, red and black.

Significance: The Hawaiian shield, representing defense, bears a stylized Hawaiian idol as the combat symbol of this squadron. The emblem carries on the historical tradition and spirit of the former emblem as it retains a similar color scheme as well as Hawaiian idol design. The red and black shock waves adapt the design to modern concepts. The red, black, and yellow colors were traditionally used for the feather capes and helmets which the Hawaiian kings and chiefs of old wore in battle.

The emblem was designed by Capt Kurt E. Johnson, and updated the earlier 199th Fighter Squadron (SE) emblem approved 11 October 1951. Approved 18 September 1961.

Related Retiree News post: Hawaii National Guard Unit Emblems: 199th Fighter Squadron

The Kūkā‘ilimoku is the official e-newsletter of the 154th Wing, Hawaii Air National Guard. The first issue came in September 1957 and continues as an e-newsletter today.

Today we feature the June 1981 Kūkā‘ilimoku issue. This issue includes the following stories:

* 154th Composite Group members back from Cope Thunder and Combat Sage

* Clinton “Church” Churchill becomes Gaspro president

* CAM Sq News & Views

* Sports News

The home page header image on the Retiree News website features Hawai‘i National Guard photographs. Each time you log on, a different photograph appears. On some computers, if you click on the photograph, another one will appear. The system has a limit of 25 images.

A quick description of these photographs:

* F-22 Raptors on the Marine Corps Base, Hawai‘i ramp

* KC-135R Stratotankers taxiing at Hickam AFB, Hawai‘i

* KC-135R Stratotanker takeoff from Hickam AFB, Hawai‘i

* Artillery from the 1st Battalion, 487th Field Artillery Regiment at Governor David Ige’s second inauguration ceremony at the State Capitol

* 29th Brigade Combat Team in formation at their Kapōlei facility

* Hickam Field main gate, shortly after the base opening in 1935

* Hawai‘i Army National Guard aviation facility at Wheeler Air Airfield

* Hawai‘i Army National Guard at Kapiolani Park

* 154th Composite Group formation, ‘Ewa side of the fighter hanger

* Hawai‘i National Guard facilities at Kokohead Air Station

* F-4C Phantom in flight over Oahu

* Colonel Francis A. I. “Miki” Bowers Armory in Wahiawā

* C-17 Globemaster III on takeoff from Hickam AFB, Hawai‘i

* F-86 Sabre and T-33s in formation

* F-22 Raptor takeoff from Hickam AFB, Hawai‘i

* 29th Infantry Brigade headquarters on 22nd Avenue

* F-47 Thunderbolts parked at Hickam AFB, Hawai‘i

* F-4C Phantom in flight

* F-47 Thunderbolts leaving for mission

* F-102A Delta Dagger at Dillingham Field, Hawai‘i

* F-47 Thunderbolts at a awards ceremony

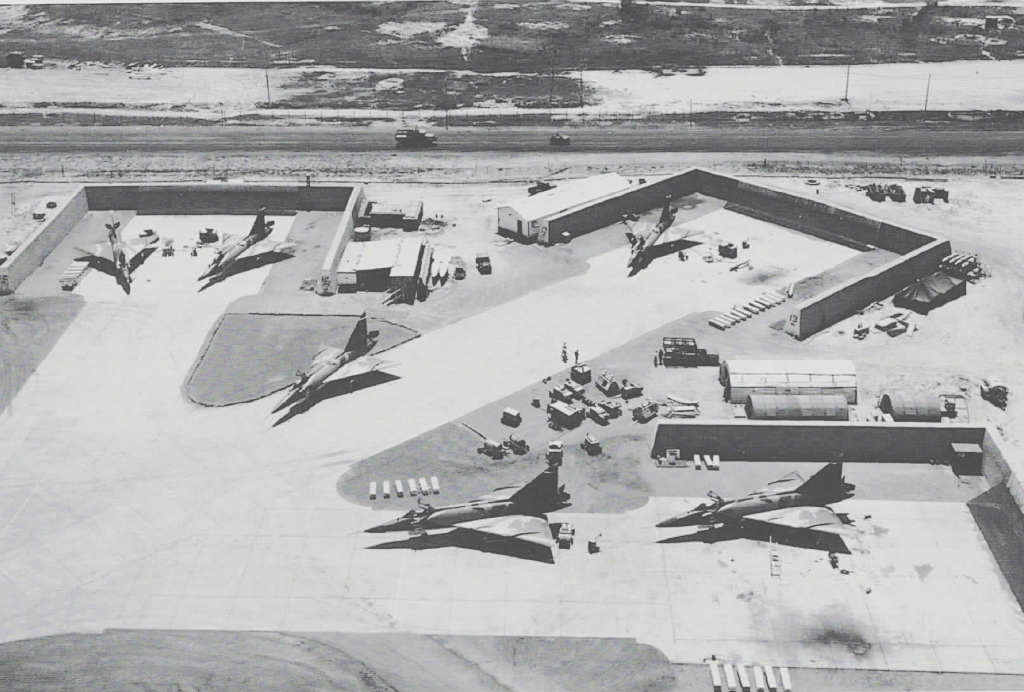

* HIANG Alert facility shortly after its opening in 1961.

* F-4C Phantoms on the MCAS Kaneohe flightline

* F-102A Delta Daggers on flightline in the early 1960s

* Governor Linda Lingle Retirement Honors Ceremony at Joint Base Pearl Harbor-Hickam